Bank transfers in Vietnam

Overview

|

Bank transfers in Vietnam is a payment method that allows customers to perform payments by using local bank transfers with banking applications, online banking and payment terminals. Purchases are performed by using Payment Page and Gate. Download the logo in vector format here. |

| Payment method type | bank transfers |

|---|---|

| Countries and regions | Viet Nam |

| Payment currencies | VND |

| Currency conversion | On the Monetix side |

| Purchases | |

| Payouts | available by using the Banks of Vietnam payment method |

| COF payments | |

| Full refunds | |

| Partial refunds | |

| Chargebacks | |

| Special considerations |

|

| Onboarding and access fee | refer to your Monetix key account manager for details |

Interaction diagram

Payment processing by using the Bank transfers in Vietnam payment method requires merchant's web service, one of Monetix interfaces (Payment Page or Gate), and the Monetix payment platform, as well technical facilities of the provider.

Operations support

| Interfaces | Amounts, VND | Times | |||||

|---|---|---|---|---|---|---|---|

| Payment Page | Gate | Dashboard | minimum | maximum | basic | threshold | |

| Purchases | * | * | 1 minute | * | |||

* Refer to your Monetix key account manager for more information.

You can check the payment amount limits in your project by using Dashboard. To check your payment amount limits, go to Dashboard, select the Projects section and click the Payment methods tab.

Processing scenarios

In the Bank transfers in Vietnam method, purchase can be performed either by redirecting customer to the provider service or by displaying the payment instructions to the customer. Refer to your key account manager at the Monetix for information about what payment scenario to use.

The sections that follow provide detailed information about what you need to perform payments and how you can analyze the information on payments and operations.

Restrictions

The number of purchases using the Bank transfers in Vietnam method for the same user (with the same customer_id) for specific amount can be limited. In other words, if the user initiates multiple identical purchases but completes none of them, the purchases are combined in a single series in which only the data for the first purchase is sent to the provider service. Once the last purchase in the series is completed and assigned the final status, the rest of the purchases in the series are declined and the platform sends callbacks with the 3613 response code. (For more information about the codes, see Operation statuses and response codes.)

By default, multiple purchases with the same amount are combined in a single series for 30 minutes after the user initiates the first purchase. Here an example of scenario of multiple purchases with the same amount:

- The user initiates the first purchase with amount of

500 VND. The purchase data are sent to the provider service, and then the payment platform receives the data for redirecting the user to the provider service. The user does not complete the purchase. - The user initiates the second purchase with amount of

500 VND. The purchase data are not sent to the provider service, and the payment platform redirects the user to the provider service by using the data the payment platform have received when initiating the first purchase. The user again does not complete the purchase. - The user initiates the third purchase with amount of

500 VND. The purchase data are not sent to the provider service, and the payment platform redirects the user to the provider service by using the data the payment platform received when initiating the first purchase. The user completes the purchase. The purchase is assigned the final status, and the first and the second purchases are automatically rejected.

Once all the purchases are assigned their final statuses, the corresponding callbacks are sent to the web service.

Multiple purchases of the same user (with the same customer_id) with the amount which differs from the amount of any of the previous purchases do not create any series, instead each purchase spawns a new queue. Here an example of scenario of multiple purchases with different amounts:

- The user initiates the first purchase with amount of

500 VND. The purchase data are sent to the provider service, and then the payment platform receives the data for redirecting the user to the provider service. The user does not complete the first purchase. - The user initiates the second purchase with amount of

600 VND. The purchase data are sent to the provider service, and then the payment platform receives the data for redirecting the user to the provider service. The user does not complete the second purchase. - The user initiates the third purchase with amount of

700 VND. The purchase data are sent to the provider service, and then the payment platform receives the data for redirecting the user to the provider service. The user does not complete the third purchase. - The user initiates the fourth purchase with amount of

800 VND. The purchase data are not sent to the provider service because of three-attempts limit. The payment platform receives the data for redirecting the user to the provider service which have been received when initiating the purchase for700 VND.

Once the number of initiated purchases for different amounts (in which no amount is used twice) exceeds three, the user is redirected to the provider service with the redirection data of the last initiated purchase for unique amount. In our scenario, it is amount of 700 VND.

Thus, a new user session won't start, unless one of purchases from the series is successfully completed or the current session times out. The user is confined by the 30-minutes limit and three redirections to the provider service.

Monetix reserves the right to change the time-out period and the allowed number of attempts and will notify of any changes of these limits in a separate message.

Supported banks

Payments with Bank transfers in Vietnam are carried out through banks that support the method. When using Payment Page, customer generally selects the bank in the payment form, although in payments that use Payment Page with pre-selected payment method and bank or Gate, the customer must select the bank on the web service side and request must contain the bank ID.

The tables below provide information about supported banks. The list is provided for informational purposes only.

| Bank | ID |

|---|---|

| SACOMBANK - NH Sai gon Thuong Tin | 131 |

| TECHCOMBANK - NH Ky Thuong | 132 |

| VIETCOMBANK - NH Ngoai Thuong Viet Nam | 133 |

| VIETINBANK - NH Cong Thuong VN | 134 |

| BIDV - NH Dau Tu va Phat Trien VN | 136 |

| VIB - NH Quoc Te | 138 |

| AGRIBANK - NH Nong Nghiep va PTNT VN | 139 |

| ACB - NH A Chau | 150 |

| MSB- NH Hang Hai | 440 |

| TPBANK - NH Tien Phong | 445 |

| MBBANK - NH Quan Doi | 447 |

| VPBANK - NH Viet Nam Thinh Vuong | 449 |

Purchase by using Payment Page. Channel 1: customer redirection

General information

In the Bank transfers in Vietnam method, to perform a purchase by using Payment Page, the merchant web service is required to send a request with all the required parameters and signature to the Monetix URL and accept the callback with the payment result from the payment platform. When opening Payment Page, you can have Payment Page opened with the Bank transfers in Vietnam method preselected. For more information about preselecting payment methods, see Preselecting payment methods. The full sequence and particularities of the purchase process are provided below.

- Customer initiates a purchase on the merchant's web service.

- The web service sends the request for Payment Page opening to the specified Monetix URL.

- The request for opening is redirected to the payment platform.

- The payment platform performs the initial request processing that involves validation of the required parameters and the signature.

- Requested Payment Page is generated inside the Monetix payment platform as specified in the project settings and the request parameters.

- Payment Page is displayed to the customer.

- The customer selects the Bank transfers in Vietnam method.

- The payment platform receives the purchase request for payment processing from Payment Page.

- The payment platform further processes the purchase request and sends it to the provider service.

- The purchase request is processed on the provider service side.

- The provider service generates the data for redirecting the customer to its website form and sends the data to the payment platform.

- The payment platform sends the customer redirection data to Payment Page.

- The customer is redirected to the provider website.

- The customer completes all the payment steps required.

- The payment is processed on the provider side.

- The result is displayed to the customer on the provider website.

- The customer is redirected to Payment Page.

- The provider service sends the notification about the payment result to the payment platform.

- The payment platform sends a callback with the payment result information to the web service.

- The payment platform sends the result to Payment Page.

- A page with the payment result information is displayed to the customer on Payment Page.

The sections that follow discuss in more details the request format and the Payment Page parameters to use in the Bank transfers in Vietnam payment method and provide the information about the format of callbacks with payment results. For the general information on how to use the API, see Payment Page API Description.

Request format

There are several things you need to consider when using the Bank transfers in Vietnam method:

- You must provide values for the basic minimum of parameters. Listed below are the parameters that are required for any payment method:

- project_id—project ID obtained from Monetix

- payment_id—payment ID unique within the project

- customer_id—unique ID of the customer within your project

- customer_first_name—customer first name

- customer_last_name—customer last name

- customer_email—customer email address

- payment_currency—payment currency in ISO-4217 alpha-3 format

- payment_amount—purchase amount in major currency units without any fractional part.

If the currency does have minor units (that is, the number of digits for minor currency units is not zero), then you must set this parameter to the amount in minor currency units without any decimal point or comma . For the information on whether the currency has any minor units, see Currency codes.

- If you need to have payment form displayed with the Bank transfers in Vietnam method preselected, set the force_payment_method parameter to

bank-transfer-vietnam. - If required, you can also add any other additional parameters Payment Page supports. For information about all parameters available in the Bank transfers in Vietnam payment method, see Payment Page invocation parameters.

- After you specify all the parameters you need, you are required to create the signature for the request. For instructions on how to sign a payment request, see Signature generation and verification.

Here is an example of data from a request for Payment Page opening:

EPayWidget.run(

{ project_id: 214,

payment_id: 'X03936',

customer_id: 'customer_123',

customer_first_name: 'John',

customer_last_name: 'Doe',

customer_email: 'example@email.com',

payment_amount: 300000,

payment_currency: 'VND',

signature: "kUi2x9dKHAVNU0FYldJrxhRLCvhtT4DqtVUkDJrOcZzUCwX6R\/ekpZhkIQg=="

}

)

Callback format

The Bank transfers in Vietnam method uses the standard format for callbacks to deliver purchase results. For more information, see Callbacks in Payment Page.

- number—customer's account number

- customer_name—customer's name

- bank_code—customer's bank code

Please contact your Monetix key account manager to confirm whether this option is available to you.

The following is the example of a callback with an information about successful 300,000 VND purchase made in the 1234 project.

{

"project_id": 1234,

"payment": {

"id": "EP0c8a-960e",

"type": "purchase",

"status": "success",

"date": "2021-02-10T10:10:14+0000",

"method": "Vietnam bank transfer",

"sum": {

"amount": 300000,

"currency": "VND"

},

"description": ""

},

"account": {

"number": "123456789012",

"customer_name": "John Doe",

"bank_code": "Vietinbank"

},

"operation": {

"id": 360,

"type": "sale",

"status": "success",

"date": "2021-02-10T10:10:14+0000",

"created_date": "2021-02-10T10:09:34+0000",

"request_id": "cca222750e99b05bc6656ec2d82df16cbb241a7-00000001",

"sum_initial": {

"amount": 300000,

"currency": "VND"

},

"sum_converted": {

"amount": 300000,

"currency": "VND"

},

"code": "0",

"message": "Success",

"provider": {

"id": 2885,

"payment_id": "161295179796",

"auth_code": "",

"date": "2021-02-10T10:09:57+0000"

}

},

"signature": "9sHwkk4fbhwQg3PH/8ShWtbqgBZEcfaC+HnVrQe6DFFCQX14w=="

}

The following is the example of a callback for a declined purchase.

{

"project_id": 1234,

"payment": {

"id": "EP20e2-f529",

"type": "purchase",

"status": "decline",

"date": "2021-02-10T10:17:53+0000",

"method": "Vietnam bank transfer",

"sum": {

"amount": 300000,

"currency": "VND"

},

"description": ""

},

"account": {

"number": "123456789012",

"customer_name": "John Doe",

"bank_code": "Vietinbank"

},

"operation": {

"id": 362,

"type": "sale",

"status": "decline",

"date": "2021-02-10T10:17:53+0000",

"created_date": "2021-02-10T10:17:20+0000",

"request_id": "3c4c7fd62077fb13939f918db3ad68ac67b6-00000001",

"sum_initial": {

"amount": 300000,

"currency": "VND"

},

"sum_converted": {

"amount": 300000,

"currency": "VND"

},

"code": "20000",

"message": "General decline",

"provider": {

"id": 2885,

"payment_id": "161295225928",

"auth_code": "",

"date": "2021-02-10T10:17:39+0000"

}

},

"signature": "OFk5zqGjZF7yAGjTdIY3vQs6i27N26bWHRM3hOBLgOg2n3pLoqTA=="

}

Related topics

The following topics might be useful when implementing payments by using Payment Page:

Purchase by using Payment Page. Channel 2: no customer redirection

General information

In the Bank transfers in Vietnam method, to perform a purchase by using Payment Page, the merchant web service is required to send a request with all the required parameters and signature to the Monetix URL and accept the callback with the payment result from the payment platform. When opening Payment Page, you can have Payment Page opened with the Bank transfers in Vietnam method preselected. For more information about preselecting payment methods, see Preselecting payment methods. The full sequence and particularities of the purchase process are provided below.

- Customer initiates a purchase on the merchant's web service.

- The web service sends the request for Payment Page opening to the specified Monetix URL.

- The request for opening is redirected to the payment platform.

- The payment platform performs the initial request processing that involves validation of the required parameters and the signature.

- Requested Payment Page is generated inside the Monetix payment platform as specified in the project settings and the request parameters.

- Payment Page is displayed to the customer.

- The customer selects the Bank transfers in Vietnam method.

- The payment platform receives the purchase request for payment processing from Payment Page.

- The payment platform further processes the purchase request and sends it to the provider service.

- The purchase request is processed on the provider service side.

- The provider service sends the payment instruction data to the payment platform.

- The payment platform sends the payment instruction data to Payment Page.

- The payment screen with payment instructions is displayed to the customer.

- The customer completes all the payment steps required.

- The payment is processed on the provider side.

- The provider service sends the notification about the payment result to the payment platform.

- The payment platform sends a callback with the payment result information to the web service.

- The payment platform sends the result to Payment Page.

- A page with the payment result information is displayed to the customer on Payment Page.

The sections that follow discuss in more details the request format and the Payment Page parameters to use in the Bank transfers in Vietnam payment method and provide the information about the format of callbacks with payment results. For the general information on how to use the API, see Payment Page API Description.

Request format

There are several things you need to consider when using the Bank transfers in Vietnam method:

- You must provide values for the basic minimum of parameters. Listed below are the parameters that are required for any payment method:

- project_id—project ID obtained from Monetix

- payment_id—payment ID unique within the project

- customer_id—unique ID of the customer within your project

- customer_first_name—customer first name

- customer_last_name—customer last name

- customer_email—customer email address

- payment_currency—payment currency in ISO-4217 alpha-3 format

- payment_amount—purchase amount in major currency units without any fractional part.

If the currency does have minor units (that is, the number of digits for minor currency units is not zero), then you must set this parameter to the amount in minor currency units without any decimal point or comma . For the information on whether the currency has any minor units, see Currency codes.

- If you need to have payment form displayed with the Bank transfers in Vietnam method preselected, set the force_payment_method parameter to

bank-transfer-vietnam. - If required, you can also add any additional parameters Payment Page supports. For information about all parameters available in the Bank transfers in Vietnam payment method, see Payment Page invocation parameters.

- After you specify all the parameters you need, you are required to create a signature for the request. For instructions on how to sign payment request, see Signature generation and verification.

Here is an example of data from a request for Payment Page opening:

EPayWidget.run(

{ payment_id: 'X03936',

payment_amount: 300000,

payment_currency: 'VND',

project_id: 214,

customer_id: 'customer_123',

customer_first_name: 'John',

customer_last_name: 'Doe',

customer_email: 'example@email.com',

signature: "kUi2x9dKHAVNU0FYldJrxhRLCvhtT4DqtVUkDJrOcZzUCwX6R\/ekpZhkIQg=="

}

)

Callback format

The Bank transfers in Vietnam method uses the standard format for callbacks to deliver purchase results. For more information, see Callbacks in Payment Page.

- number—customer's account number

- customer_name—customer's name

- bank_code—customer's bank code

Please contact your Monetix key account manager to confirm whether this option is available to you.

The following is the example of a callback with an information about successful 300,000 VND purchase made in the 1234 project.

{

"project_id": 1234,

"payment": {

"id": "EP0c8a-960e",

"type": "purchase",

"status": "success",

"date": "2021-02-10T10:10:14+0000",

"method": "Vietnam bank transfer",

"sum": {

"amount": 300000,

"currency": "VND"

},

"description": ""

},

"account": {

"number": "123456789012",

"customer_name": "John Doe",

"bank_code": "Vietinbank"

},

"operation": {

"id": 360,

"type": "sale",

"status": "success",

"date": "2021-02-10T10:10:14+0000",

"created_date": "2021-02-10T10:09:34+0000",

"request_id": "cca222750e99b05bc6656ec2d82df16cbb241a7-00000001",

"sum_initial": {

"amount": 300000,

"currency": "VND"

},

"sum_converted": {

"amount": 300000,

"currency": "VND"

},

"code": "0",

"message": "Success",

"provider": {

"id": 2885,

"payment_id": "161295179796",

"auth_code": "",

"date": "2021-02-10T10:09:57+0000"

}

},

"signature": "9sHwkk4fbhwQg3PH/8ShWtbqgBZEcfaC+HnVrQe6DFFCQX14w=="

}

The following is the example of a callback for a declined purchase.

{

"project_id": 1234,

"payment": {

"id": "EP20e2-f529",

"type": "purchase",

"status": "decline",

"date": "2021-02-10T10:17:53+0000",

"method": "Vietnam bank transfer",

"sum": {

"amount": 300000,

"currency": "VND"

},

"description": ""

},

"account": {

"number": "123456789012",

"customer_name": "John Doe",

"bank_code": "Vietinbank"

},

"operation": {

"id": 362,

"type": "sale",

"status": "decline",

"date": "2021-02-10T10:17:53+0000",

"created_date": "2021-02-10T10:17:20+0000",

"request_id": "3c4c7fd62077fb13939f918db3ad68ac67b6-00000001",

"sum_initial": {

"amount": 300000,

"currency": "VND"

},

"sum_converted": {

"amount": 300000,

"currency": "VND"

},

"code": "20000",

"message": "General decline",

"provider": {

"id": 2885,

"payment_id": "161295225928",

"auth_code": "",

"date": "2021-02-10T10:17:39+0000"

}

},

"signature": "OFk5zqGjZF7yAGjTdIY3vQs6i27N26bWHRM3hOBLgOg2n3pLoqTA=="

}

Related topics

The following topics might be useful when implementing payments by using Payment Page:

Purchase by using Gate. Channel 1: customer redirection

General information

In the Bank transfers in Vietnam method, when processing a purchase by using Gate, the merchant web service is required to do the following:

- Send a request with all the required parameters and signature to the Monetix URL.

- Redirect customer to the provider service.

- Get a callback with the payment result from the payment platform.

The following diagram provides the detailed picture of the payment processing procedure.

- Customer initiates a purchase through Bank transfers in Vietnam payment method.

- The web service sends the request for processing the purchase by using Gate to the specified Monetix URL.

- The payment platform receives the request for processing the purchase from Gate.

- The payment platform performs the initial request processing that includes validation of the required parameters and signature.

- The payment platform sends the response with request receipt confirmation and correctness check result to the web service. For more information, see Response structure.

- The payment platform performs processes the payment request and redirects the request to the provider service.

- The request is processed on the provider side.

- The provider service sends the data for redirecting the customer to the provider service to the payment platform.

- The payment platform sends the callback with the redirection data in the redirect_data object to the web service.

- The customer is redirected from the web service to the provider service.

- The customer completes all the payment steps required.

- The payment is processed on the provider side.

- The result is displayed to the customer.

- The customer is redirected to the merchant's web service.

- The provider service sends the payment result notification to the payment platform.

- The payment platform sends a callback to the web service.

- The customer receives the payment result on the web service.

The sections that follow discuss in more details the request format and the Gate parameters to use in the Bank transfers in Vietnam payment method and provide the information about formats of the data for redirecting customers and the information about the format of callbacks with payment results. For the general information about using the Gate API, see API Description.

Request format

There are several things you must consider when using purchase requests in the Bank transfers in Vietnam method:- You perform purchases by sending the request to the

/v2/payment/bank-transfer/vietnam/saleendpoint by using POST (HTTP) method. This is a group of endpoints for bank transfer payments: /v2/payment/bank-transfer/{payment_method}/sale - The following objects and parameters must be specified in any request:

- general—object with general request identification information:

- project_id—the project ID obtained from Monetix

- payment_id—payment ID unique within the project

- signature—signature created after you specify all the required parameters. For more information about signature generation, see Signature generation and verification.

- customer—object with customer information:

- id—the unique ID of the customer within your project

- ip_address—customer device IP

- first_name—customer first name

- last_name—customer last name

- email—customer email address

- account—object with customer account information:

- bank_id—bank identifier. This parameter may not be mandatory. Refer to you Key Account Manager at Monetix for details.

- payment—object with purchase information:

- amount—purchase amount in major currency units without any fractional part.

If the currency does have minor units (that is, the number of digits for minor currency units is not zero), then you must set this parameter to the amount in minor currency units without any decimal point or comma . For the information on whether the currency has any minor units, see Currency codes.

- currency—code of the purchase currency in the ISO-4217 alpha-3 format

- amount—purchase amount in major currency units without any fractional part.

- return_url—object with the information where to redirect the customer to when the payment is completed or prematurely terminated by the customer:

- success—the URL to redirect the customer to after the payment is successfully completed. This parameter may not be mandatory. Refer to you Key Account Manager at Monetix for details.

- decline—URL for redirecting when payment fails. This parameter may not be mandatory. Refer to you Key Account Manager at Monetix for details.

- general—object with general request identification information:

- The following parameter with the return URL is optional, but we strongly advise you to specify it in the request to provide your customer a better user experience. If you don't specify any parameters of the return_url object in the request, by default Gate will redirect the customer to the URL specified in your project in Monetix.

- return_url—object with the information where to redirect the customer to when the payment is completed or prematurely terminated by the customer:

- return—the URL to redirect the customer to when they prematurely terminate the payment. This URL is also used if the success and decline parameters are not specified in the request

- return_url—object with the information where to redirect the customer to when the payment is completed or prematurely terminated by the customer:

- If required, you can add any other additional parameters Gate supports.

Here is an example of data from a purchase request in the Bank transfers in Vietnam method.

{

"general": {

"project_id": 1234,

"payment_id": "payment_47",

"signature": "PJkV8ej\/UG0Di8NN5e7cV+VHq3oXW\/9MTO8yJA=="

},

"payment": {

"amount": 30000,

"currency": "VND"

},

"account": {

"bank_id": 205

},

"customer": {

"id": "123",

"ip_address": "198.51.100.47",

"first_name": "John",

"last_name": "Doe",

"email": "example@email.com"

},

"return_url": {

"success": "https://example.com/success/",

"decline": "https://example.com/decline/",

"return": "https://example.com/return/"

}

}

Formats of the customer redirection data

To redirect a customer from the web service to the bank site, you are required to accept a callback from the payment platform with a redirect_data object which contains the URL for redirecting the customer in the url parameter and the data to be sent in the request body in the body parameter. Use these parameters to open the web page by using the HTML method specified in the method parameter.

The following is the callback fragment containing the redirection data.

"redirect_data": {

"method": "GET",

"body": [],

"encrypted": [],

"url": "http://example.com/redirect"

}Callback format

The Bank transfers in Vietnam method uses the standard format for callbacks to deliver purchase results. For more information, see Callbacks in Gate.

- number—customer's account number

- customer_name—customer's name

- bank_code—customer's bank code

Please contact your Monetix key account manager to confirm whether this option is available to you.

The following is the example of a callback with an information about successful 300,000 VND purchase made in the 1234 project.

{

"project_id": 1234,

"payment": {

"id": "EP0c8a-960e",

"type": "purchase",

"status": "success",

"date": "2021-02-10T10:10:14+0000",

"method": "Vietnam bank transfer",

"sum": {

"amount": 300000,

"currency": "VND"

},

"description": ""

},

"account": {

"number": "123456789012",

"customer_name": "John Doe",

"bank_code": "Vietinbank"

},

"operation": {

"id": 360,

"type": "sale",

"status": "success",

"date": "2021-02-10T10:10:14+0000",

"created_date": "2021-02-10T10:09:34+0000",

"request_id": "cca222750e99b05bc6656ec2d82df16cbb241a7-00000001",

"sum_initial": {

"amount": 300000,

"currency": "VND"

},

"sum_converted": {

"amount": 300000,

"currency": "VND"

},

"code": "0",

"message": "Success",

"provider": {

"id": 2885,

"payment_id": "161295179796",

"auth_code": "",

"date": "2021-02-10T10:09:57+0000"

}

},

"signature": "9sHwkk4fbhwQg3PH/8ShWtbqgBZEcfaC+HnVrQe6DFFCQX14w=="

}

The following is the example of a callback for a declined purchase.

{

"project_id": 1234,

"payment": {

"id": "EP20e2-f529",

"type": "purchase",

"status": "decline",

"date": "2021-02-10T10:17:53+0000",

"method": "Vietnam bank transfer",

"sum": {

"amount": 300000,

"currency": "VND"

},

"description": ""

},

"account": {

"number": "123456789012",

"customer_name": "John Doe",

"bank_code": "Vietinbank"

},

"operation": {

"id": 362,

"type": "sale",

"status": "decline",

"date": "2021-02-10T10:17:53+0000",

"created_date": "2021-02-10T10:17:20+0000",

"request_id": "3c4c7fd62077fb13939f918db3ad68ac67b6-00000001",

"sum_initial": {

"amount": 300000,

"currency": "VND"

},

"sum_converted": {

"amount": 300000,

"currency": "VND"

},

"code": "20000",

"message": "General decline",

"provider": {

"id": 2885,

"payment_id": "161295225928",

"auth_code": "",

"date": "2021-02-10T10:17:39+0000"

}

},

"signature": "OFk5zqGjZF7yAGjTdIY3vQs6i27N26bWHRM3hOBLgOg2n3pLoqTA=="

}

Related topics

The following topics might be useful when implementing payments through Gate:

Purchase by using Gate. Channel 2: no customer redirection

General information

In the Bank transfers in Vietnam method, when processing a purchase by using Gate, the merchant web service is required to do the following:

- Send a request with all the required parameters and signature to the Monetix URL.

- Display the payment instructions to the customer.

- Get a callback with the payment result from the payment platform.

The following diagram provides the detailed picture of the payment processing procedure.

- Customer initiates a purchase through Bank transfers in Vietnam payment method.

- The web service sends the request for processing the purchase by using Gate to the specified Monetix URL.

- The payment platform receives the request for processing the purchase from Gate.

- The payment platform performs the initial request processing that includes validation of the required parameters and signature.

- The payment platform sends the response with request receipt confirmation and correctness check result to the web service. For more information, see Response structure.

- The payment platform performs processes the payment request and redirects the request to the provider service.

- The request is processed on the provider side.

- The provider service sends the payment instruction data to the payment platform.

- The payment platform sends the callback with the payment instructions data to the web service.

- The payment instructions are displayed to the customer.

- The customer completes all the payment steps required.

- The payment is processed on the provider side.

- The provider service sends the payment result notification to the payment platform.

- The payment platform sends a callback to the web service.

- The customer receives the payment result on the web service.

The sections that follow discuss in more details the request format and the Gate parameters to use in the Bank transfers in Vietnam payment method and provide the information about formats of the data for redirecting customers and the information about the format of callbacks with payment results. For the general information about using the Gate API, see API Description.

Request format

There are several things you must consider when using purchase requests in the Bank transfers in Vietnam method:- You perform purchases by sending the request to the

/v2/payment/bank-transfer/vietnam/saleendpoint by using POST (HTTP) method. This is a group of endpoints for bank transfer payments: /v2/payment/bank-transfer/{payment_method}/sale - The following objects and parameters must be specified in any request:

- general—object with general request identification information:

- project_id—the project ID obtained from Monetix

- payment_id—payment ID unique within the project

- signature—signature created after you specify all the required parameters. For more information about signature generation, see Signature generation and verification.

- customer—object with customer information:

- id—the unique ID of the customer within your project

- ip_address—customer device IP

- first_name—customer first name

- last_name—customer last name

- email—customer email address

- payment—object with purchase information:

- amount—purchase amount in major currency units without any fractional part.

If the currency does have minor units (that is, the number of digits for minor currency units is not zero), then you must set this parameter to the amount in minor currency units without any decimal point or comma . For the information on whether the currency has any minor units, see Currency codes.

- currency—code of the purchase currency in the ISO-4217 alpha-3 format

- amount—purchase amount in major currency units without any fractional part.

- account—object with customer account information:

- bank_id—bank identifier. This parameter may not be mandatory. Refer to you Key Account Manager at Monetix for details.

- general—object with general request identification information:

- If required, you can add any other additional parameters Gate supports.

Here is an example of data from a purchase request in the Bank transfers in Vietnam method.

{

"general": {

"project_id": 211,

"payment_id": "payment_id",

"signature": "PJkV8ej\/UG0Di8NN5e7cV+VHq3oXW\/9MTO8yJA=="

},

"payment": {

"amount": 30000,

"currency": "VND"

},

"customer": {

"id": "123",

"ip_address": "198.51.100.47",

"first_name": "John",

"last_name": "Doe",

"email": "example@email.com"

}

}

Format of data for displaying the payment instruction

Before displaying the screen with payment instructions to the customer, you must accept a callback from the payment platform with the payment data in the in the display_data array—only after this you can display the screen with payment instructions to the customer.

There are two options the way the display_data array is structured. Both of them are described below. Refer to you Key Account Manager at Monetix for details on which one is relevant for you.

Option 1

Each element of the display_data array contains the following parameters:

- type—element type (always

add_info) - title—the name of the payment instruction data, can take the following values:

- bank_name—name of the payment recipient bank

- number—account number of the payment recipient

- fullName—full name of the payment recipient

- branch—branch name of the payment recipient bank

- content—payment description

- swiftCode—SWIFT code of the payment recipient bank

- data—payment instruction data

Here is a sample of a callback with a display_data object.

"display_data": [ { "type": "add_info", "title": "bankName", "data": "Wooribank Việt Nam" }, { "type": "add_info", "title": "number", "data": "902014188917" }, { "type": "add_info", "title": "fullName", "data": "PAYME MNTX" }, { "type": "add_info", "title": "branch", "data": "Hà Nội" }, { "type": "add_info", "title": "content", "data": "TT 8575" }, { "type": "add_info", "title": "swiftCode", "data": "HVBKVNVXXXX" } ]

Here is an example of a payment instruction text which can be used in payment instruction in the web service:

| Instruction text in Vietnamese | Instruction text in English |

|---|---|

|

|

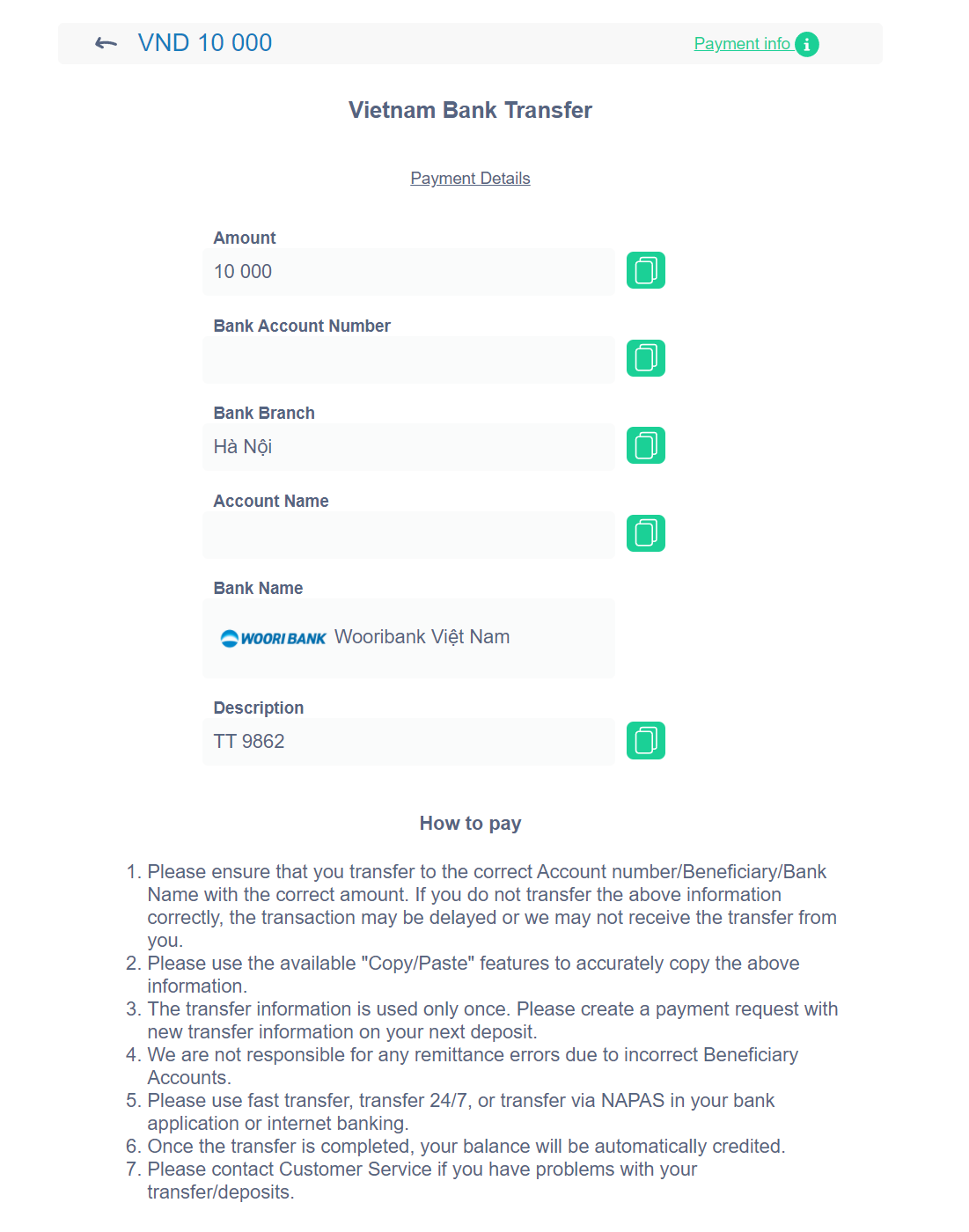

Here is an example of a payment instruction which can be used in the web service:

Option 2

Each element of the display_data array contains the following parameters:

- type—element type (always

add_info) - title—the name of the payment instruction data, can take the following values:

- transfer_code—bank transfer code, which should be specified by customer during purchasing

- account_no—account number of the payment recipient

- account_name—full name of the payment recipient

- request_amount—payment amount

- code—code of the payment recipient bank

- bank_name—name of the payment recipient bank

- bank_abbr—acronym of the payment recipient bank name

- data—payment instruction data

Here is a sample of a callback with a display_data object.

"display_data": [ { "type": "add_info", "title": "transfer_code", "data": "B1234567890" }, { "type": "add_info", "title": "account_no", "data": "1234123412341" }, { "type": "add_info", "title": "account_name", "data": "John Doe" }, { "type": "add_info", "title": "request_amount", "data": "10000" }, { "type": "add_info", "title": "code", "data": "MBBANK" }, { "type": "add_info", "title": "bank_name", "data": "Military Bank" }, { "type": "add_info", "title": "bank_abbr", "data": "MB" } ]

Here is an example of a payment instruction text which can be used in payment instruction in the web service:

| Instruction text in Vietnamese | Instruction text in English |

|---|---|

|

|

Callback format

The Bank transfers in Vietnam method uses the standard format for callbacks to deliver purchase results. For more information, see Callbacks in Gate.

- number—customer's account number

- customer_name—customer's name

- bank_code—customer's bank code

Please contact your Monetix key account manager to confirm whether this option is available to you.

The following is the example of a callback with an information about successful 300,000 VND purchase made in the 1234 project.

{

"project_id": 1234,

"payment": {

"id": "EP0c8a-960e",

"type": "purchase",

"status": "success",

"date": "2021-02-10T10:10:14+0000",

"method": "Vietnam bank transfer",

"sum": {

"amount": 300000,

"currency": "VND"

},

"description": ""

},

"account": {

"number": "123456789012",

"customer_name": "John Doe",

"bank_code": "Vietinbank"

},

"operation": {

"id": 360,

"type": "sale",

"status": "success",

"date": "2021-02-10T10:10:14+0000",

"created_date": "2021-02-10T10:09:34+0000",

"request_id": "cca222750e99b05bc6656ec2d82df16cbb241a7-00000001",

"sum_initial": {

"amount": 300000,

"currency": "VND"

},

"sum_converted": {

"amount": 300000,

"currency": "VND"

},

"code": "0",

"message": "Success",

"provider": {

"id": 2885,

"payment_id": "161295179796",

"auth_code": "",

"date": "2021-02-10T10:09:57+0000"

}

},

"signature": "9sHwkk4fbhwQg3PH/8ShWtbqgBZEcfaC+HnVrQe6DFFCQX14w=="

}

The following is the example of a callback for a declined purchase.

{

"project_id": 1234,

"payment": {

"id": "EP20e2-f529",

"type": "purchase",

"status": "decline",

"date": "2021-02-10T10:17:53+0000",

"method": "Vietnam bank transfer",

"sum": {

"amount": 300000,

"currency": "VND"

},

"description": ""

},

"account": {

"number": "123456789012",

"customer_name": "John Doe",

"bank_code": "Vietinbank"

},

"operation": {

"id": 362,

"type": "sale",

"status": "decline",

"date": "2021-02-10T10:17:53+0000",

"created_date": "2021-02-10T10:17:20+0000",

"request_id": "3c4c7fd62077fb13939f918db3ad68ac67b6-00000001",

"sum_initial": {

"amount": 300000,

"currency": "VND"

},

"sum_converted": {

"amount": 300000,

"currency": "VND"

},

"code": "20000",

"message": "General decline",

"provider": {

"id": 2885,

"payment_id": "161295225928",

"auth_code": "",

"date": "2021-02-10T10:17:39+0000"

}

},

"signature": "OFk5zqGjZF7yAGjTdIY3vQs6i27N26bWHRM3hOBLgOg2n3pLoqTA=="

}

Related topics

The following topics might be useful when implementing payments through Gate:

Testing

General information

You can perform test purchases with the Bank transfers in Vietnam payment method by using Payment Page and Gate.

To perform test purchases, you'll need the test project ID and the secret key to it. To get them, please contact the technical support team at support@monetix.pro and then contact your Monetix key account manager to set up a test environment to work with the Bank transfers in Vietnam payment method.

When performing test payments, keep in mind that:

- your requests must contain the test project ID

- the payment currency that you send in requests can be only VND

- random values may be used as the payment ID and in the parameters with customer information

- the interface of the test checkout page may be different from the production one.

Test payments statuses

To receive one of the following statuses in the callback with the test purchase result, use a particular value for the purchase amount in the request:

400and404—to receive a callback with the decline status- any other value—to receive a callback with the success status

Testing purchase by using Payment Page

To perform a test purchase by using Payment Page:

- Send a request for purchase through Payment Page to the payment platform.

- Choose a payment method on the test checkout page. If you've passed the force_payment_method parameter with the

bank-transfer-vietnamvalue in the request, you won't have to choose the payment method. - Specify a random first name and last name in the data entry fields. The payment instructions will be displayed to you after.

- Accept a callback with information about the test purchase result.

- Wait a few seconds until the result of the test purchase is displayed to you on the test checkout page.

See the detailed information about purchase processing through Payment Page in the Bank transfers in Vietnam payment method in the Purchase by using Payment Page section.

Testing purchase by using Gate

To perform a test purchase by using Gate:

- Send a request for performing a test purchase to the payment platform.

- Accept a callback with the data for displaying payment instructions. Your system will display the payment instructions to you after.

- Accept a callback with information about the test payment result.

- Wait a few seconds until your system shows you the result of the test purchase.

See the detailed information about purchase processing through Gate in the Bank transfers in Vietnam payment method in the Purchase by using Gate section.

Analysis of payments results

As with other payment methods Monetix offers, when using this method, you have several options to analyze the information about payments and operations.

You can load and analyze all the necessary information in Dashboard (dash-light.trxhost.com), for instance you can use the analytic panels in the Analytics section for this purpose.

Also, you can export the information for further analysis by using third party analytical tools. The following options are available:

- Dashboard allows you to download reports in CSV format by using the tools in the Reports section. You can perform export as a one-time or regular download of data to your local computer.

- Data API allows you to have payment information exported in JSON format and delivered to a URL you specify. The payment information is exported by means of sending requests to the /operations/get endpoint.

If you have any further questions regarding payment data analysis, contact Monetix technical support.