Neteller

Overview

|

Neteller is a payment method to perform payments by using e-wallets. You can perform purchases through this method by using Payment Page and Gate, payouts by using Gate and Dashboard. Download the logo in vector format here. |

| Payment method type | e-wallet payments |

|---|---|

| Countries and regions | All countries, except Afghanistan, Benin, Bonaire, Sint Eustatius and Saba, Burundi, Saint Barthélemy, Central African Republic, The Congo, Cuba, Djibouti, Eritrea, Western Sahara, Gabon, Gambia, Guinea, Equatorial Guinea, Guinea-Bissau, Guyana, Islamic Republic of Iran, Iraq, Saint Kitts and Nevis, Kazakhstan, Kyrgyzstan, Lao People's Democratic Republic, Liberia, Libya, Madagascar, Saint Martin (French part), Malawi, Mali, Mauritania, Mongolia, Montserrat, Myanmar, Nauru, Niger, Niue, Norfolk Island, Democratic People's Republic of Korea, Palau, Papua New Guinea, Sint Maarten (Dutch part), Sierra Leone, South Sudan, Sudan, Suriname, Syrian Arab Republic, Chad, Tajikistan, Timor-Leste, Togo, Turkmenistan, United States of America, Uzbekistan, Yemen * |

| Payment currencies | Refer to your Monetix key account manager |

| Currency conversion | on the Monetix side * |

| Purchases | |

| Payouts | |

| COF payments | |

| Full refunds | |

| Partial refunds | |

| Chargebacks | |

| Notes | Payment Page can be opened in any way except embedded into a web page (iframe) |

| Onboarding and access fee | Refer to your Monetix key account manager |

* Refer to your Monetix key account manager for more information.

Interaction diagram

Payment processing by using the Neteller payment method requires merchant's web service, one of Monetix interfaces, and the Monetix payment platform, as well as technical facilities of Neteller.

Operations support

| Interfaces | Amounts | ||||

|---|---|---|---|---|---|

| Payment Page | Gate | Dashboard | minimum | maximum | |

| Purchases | |||||

| Payouts | |||||

You can check the payment amount limits in your project by using Dashboard. To check your payment amount limits, go to Dashboard, select the Projects section and click the Payment methods tab.

Processing scenarios

In the Neteller method, purchases and refunds follow different processing procedures. To perform a purchase operation, you need to redirect customer to the Neteller service, while to initiate a payout, you need to receive a request from the customer via the web service.

The sections that follow provide detailed information about what you need to perform payments and how you can analyze the information on payments and operations.

Purchase by using Payment Page

General information

In the Neteller method, when processing a purchase by using Payment Page, the merchant web service should send a request with all the required parameters and signature to the Monetix URL and get the callback with the payment result from the payment platform. When opening Payment Page, you can have Payment Page opened with the Neteller method selected. For more information about preselecting payment methods, see in Preselecting payment methods. The full sequence and particularities of the purchase process are provided below.

- A customer initiates a purchase on the merchant's web service.

- The web service sends the request for Payment Page opening to the specified Monetix URL.

- The request for opening is redirected to the payment platform.

- The payment platform performs the initial request processing that involves validation of the required parameters and signature.

- Requested Payment Page is generated into the Monetix payment platform as specified in the project settings and the request parameters.

- Payment Page is displayed to the customer.

- The customer selects the Neteller method.

- The payment platform receives the purchase request for payment processing from Payment Page.

- The payment platform performs the internal purchase request processing and sends it to the Neteller service.

- The purchase request is processed on the Neteller service side.

- The Neteller service generates the data for redirecting the customer to its website form and sends it to the payment platform.

- The payment platform sends the customer redirection data to Payment Page.

- The customer is redirected to the Neteller website.

- The customer completes all the payment steps required.

- The payment is processed on the Neteller side.

- The customer is redirected to Payment Page.

- The Neteller service sends the result notification to the payment platform.

- The payment platform sends a callback with the payment result to the web service.

- The payment platform sends the result to Payment Page.

- A page with the payment result information is displayed to the customer on Payment Page.

The sections that follow discuss in more details the request format and the Payment Page parameters to use in the Neteller payment method and provide the information on the format of callbacks with payment results. For the general information on how to use the API, see Payment Page API Description.

Request format

There are several things you need to consider when using the Neteller method:

- You must provide values for the basic minimum of parameters. Listed below are the parameters that are mandatory for any payment method:

- project_id—the project ID obtained from Monetix

- payment_id—payment ID unique within the project

- payment_currency—payment currency in ISO-4217 alpha-3 format

- payment_amount—payment amount in minor currency units without any decimal point or comma except for cases where the currency does not have any minor currency units. If the currency has no minor units (that is, the number of digits for minor currency units is zero), then you must set this parameter to the amount in the major currency units. For the information on whether the currency has any minor units, see Currency codes.

- customer_id—customer ID unique within the project;

- customer_first_name—customer first name

- customer_last_name—customer last name

- customer_email—customer email

- Also, you may need to add the following customer information parameters (Consult with your account manager to learn whether these parameters are mandatory):

- customer_country—customer country in the ISO 3166-1 alpha-2 format

- customer_city—city of the customer address

- customer_zip—customer postal code

- customer_address—customer address

- customer_phone—customer phone number

- It is recommended to specify the user email address associated with the Neteller account in the customer_account_number additional parameter. If the parameter is missing from the request, on Payment Page the additional field is displayed to the customer to enter the missing data. For more details about submission of additional payment information, see Submission of additional payment information.

- If you need to have payment form displayed with the Neteller method selected, set the force_payment_method parameter to

neteller-wallet. - If required, you can also add any other additional parameters Payment Page supports.

- After you specify all the parameters you need, you must create the signature for the request. For instructions on how to sign a payment request, see Signature generation and verification.

Here is an example of data from a purchase request.

EPayWidget.run(

{

project_id: 123,

payment_id: 'X03936',

payment_amount: 1000,

payment_currency: 'EUR',

customer_id: 'customer1',

customer_first_name: 'John',

customer_last_name: 'Doe',

customer_email: 'johndoe@example.com',

customer_account_number: 'test@example.com',

customer_country: 'GB',

customer_city: 'Little Whinging',

customer_zip: '123456',

customer_address: '4 Privet Drive',

customer_phone: '12345678901',

signature: 'kUi2x9dKHAVNU0FYldJrxh4yT4DqtVUkDJrOcZzUCwX6R\/ekpZhkIQg=='

}

)

For information about all parameters available in the Neteller method, see Payment Page invocation parameters.

Callback format

The Neteller method uses the standard format for callbacks to deliver purchase results. For more information, see Callbacks in Payment Page.

The following is the example of a callback with an information about successful 10.00 EUR purchase in the 210 project.

{

"project_id": 210,

"payment": {

"id": "ORDER_ID_1584627953",

"type": "purchase",

"status": "success",

"date": "2020-03-19T14:26:25+0000",

"method": "neteller",

"sum": {

"amount": 1000,

"currency": "EUR"

},

"description": "Neteller purchase success"

},

"account": {

"number": "netellertest@example.com"

},

"customer": {

"id": "123"

},

"operation": {

"id": 202,

"type": "sale",

"status": "success",

"date": "2020-03-19T14:26:25+0000",

"created_date": "2020-03-19T14:25:54+0000",

"request_id": "55e5e198a25827fc92c11262bb75936a0e9ddb1756169dd960b47aeb-00000001",

"sum_initial": {

"amount": 1000,

"currency": "EUR"

},

"sum_converted": {

"amount": 1000,

"currency": "EUR"

},

"code": "0",

"message": "Success",

"provider": {

"id": 1987,

"payment_id": "1584627957265",

"auth_code": "",

"date": "2020-03-19T14:26:24+0000"

}

},

"signature": "rv9EhRK3W1eRPzvlzZ3e3tttjgANs3z0Vi5OmH7GJ4qFqg=="

}

The following is the example of a callback for a purchase declined due to a time-out.

{

"project_id": 210,

"payment": {

"id": "ORDER_ID_1584627954",

"type": "purchase",

"status": "decline",

"date": "2020-03-19T14:26:25+0000",

"method": "neteller",

"sum": {

"amount": 1000,

"currency": "EUR"

},

"description": "Neteller purchase decline"

},

"account": {

"number": "netellertest@example.com"

},

"customer": {

"id": "123"

},

"operation": {

"id": 203,

"type": "sale",

"status": "decline",

"date": "2020-03-19T14:26:25+0000",

"created_date": "2020-03-19T14:25:54+0000",

"request_id": "55e5e198a25827fc92c11262bb75936a0e9ddb1756169dd960b47aeb-00000001",

"sum_initial": {

"amount": 1000,

"currency": "EUR"

},

"sum_converted": {

"amount": 1000,

"currency": "EUR"

},

"code": "20602",

"message": "Time-out",

"provider": {

"id": 1988,

"payment_id": "1584627957266",

"auth_code": "",

"date": "2020-03-19T14:26:24+0000"

}

},

"signature": "rv9EhRK3W1eRPzvlzZ3e3tttjgANs3z0Vi5OmH7GJ4qFqg=="

}

Related topics

The following topics might be useful when implementing payments by using Payment Page:

Purchase by using Gate

General information

In the Neteller method, when processing a purchase by using Gate, the merchant web service is required to do the following:

- Send a request with all the required parameters and signature to the Monetix URL.

- Perform the redirection of a customer to the Neteller service.

- Get the callback with the payment result from the payment platform.

The following diagram provides the detailed picture of the payment processing procedure.

- A customer initiates a purchase through Neteller on the merchant's web service side.

- The web service sends the request for processing the purchase by using Gate to the specified Monetix URL.

- The payment platform receives the request for processing the purchase from Gate.

- The payment platform performs the initial request processing that includes validation of the required parameters and signature.

- The payment platform sends the response with request receipt confirmation and correctness check result to the web service. For more information, see Response structure.

- The payment platform performs the internal payment request processing and redirects the request to the Neteller service.

- The request is processed on the Neteller side.

- The Neteller service sends the data for redirecting the customer to the Neteller service to the payment platform.

- The payment platform sends the callback with the redirection data in the redirect_data object to the web service.

- The customer is redirected from the web service to the Neteller service.

- The customer completes all the payment steps required.

- The payment is processed on the Neteller side.

- The customer is redirected to the merchant's web service.

- The Neteller service sends the payment result notification to the payment platform.

- The payment platform sends a callback to the web service.

- The customer receives the payment result on the web service.

The sections that follow discuss in more details the request format and the Gate parameters to use in the Neteller payment method and provide the information on the format of callbacks with purchase results.

Request format

There are several things you must consider when using purchase requests in the Neteller method:- You send purchase requests by sending the

/v2/payment/wallet/neteller/salerequest by using the POST HTTP method. This is an e-wallet payments request group: /v2/payment/wallet/{payment_method}/sale. - The following objects and parameters must be specified in any request:

- general—object with general request information:

- project_id—the project ID obtained from Monetix

- payment_id—payment ID unique within the project

- signature—signature created after you specify all the required parameters. For more information about signature generation, see Signature generation and verification.

- payment—object with payment information:

- amount—purchase amount in minor currency units without any decimal point or comma except for cases where the currency does not have any minor currency units. If the currency has no minor units (that is, the number of digits for minor currency units is zero), then you must set this parameter to the amount in the major currency units. For the information on whether the currency has any minor units, see Currency codes.

- currency—purchase currency in ISO-4217 alpha-3 format

- customer—object with customer information:

- ip_address—customer device IP

- id—unique ID within the merchant project

- first_name—customer first name

- last_name—customer last name

- email—customer email

- account—object with customer account information:

- number—email address associated with the Neteller account. According to the operation protocol of the Neteller service it is required to validate the values that the customers specify on the web service side and allow only those values which correspond to the format of an email address.

- general—object with general request information:

- Also, you may need to add the following customer information parameters (Consult with your account manager to learn whether these parameters are mandatory):

- customer—object with customer information:

- country—customer country in the ISO 3166-1 alpha-2 format

- city—city of the customer address

- zip—customer zip code

- address—customer address

- phone—customer phone number

- customer—object with customer information:

- The following parameters with the return URLs are optional, but we strongly advise you to specify them in the request to provide your customer a better user experience. If you don't specify any parameters of the return_url object in the request, by default Gate will redirect the customer to the URL specified in your project in Monetix.

- return_url—object with the information where to redirect the customer to when the payment is completed or prematurely terminated by the customer:

- success—the URL to redirect the customer to after the payment is successfully completed.

- decline—the URL to redirect the customer to after the payment is declined.

- return—the URL to redirect the customer to when they prematurely terminate the payment. This URL is also used if the success and decline parameters are not specified in the request.

- return_url—object with the information where to redirect the customer to when the payment is completed or prematurely terminated by the customer:

- If required, you can also add any other additional parameters Gate supports.

- After you specify all the parameters you need, you must create the signature for the request. For instructions on how to sign a payment request, see Signature generation and verification.

Here is an example of data from a purchase request.

{

"general": {

"project_id": 123,

"payment_id": "ID_178",

"signature": "PJkV8ej\/UG0Di8hTng6JvC7Y3T\/pOMeSaRfBaNIipTv+AWoXW\/9MTO8yJA=="

},

"payment": {

"amount": 100,

"currency": "EUR"

},

"customer": {

"ip_address": "198.51.100.47",

"id": "customer373563",

"first_name": "John",

"last_name": "Doe",

"email": "email@example.com",

"country": "GB",

"city": "Little Whinging",

"zip": "123456",

"address": "4 Privet Drive",

"phone": "12345678901"

},

"account": {

"number": "test@example.com"

},

"return_url": {

"success": "https://example.com/success/",

"decline": "https://example.com/decline/",

"return": "https://example.com/return/"

}

}

Formats of the customer redirection data

After receiving and processing your purchase request, the payment platform sends a callback to your web service containing the data to redirect the customer to the Neteller service.

To redirect the customer, use the values of the following parameters in the redirect_data object:

- url—the URL to redirect the customer to

- body—the data to be sent in the request body

- method—the HTTP method to get an HTML page of the website (for example, POST or GET)

- encrypted—this is the service parameter. Ignore the data it contains.

Here is an example of a piece of callback containing the data to redirect the customer.

"redirect_data": { "method": "GET", "body": [], "encrypted": [], "url": "https://example.com/redirect" }

Callback format

The Neteller method uses the standard format for callbacks to deliver purchase results. For more information, see Callbacks in Gate.

The following is the example of a callback with an information about successful 10.00 EUR purchase in the 210 project.

{

"project_id": 210,

"payment": {

"id": "ORDER_ID_1584627953",

"type": "purchase",

"status": "success",

"date": "2020-03-19T14:26:25+0000",

"method": "neteller",

"sum": {

"amount": 1000,

"currency": "EUR"

},

"description": "Neteller purchase success"

},

"account": {

"number": "netellertest@example.com"

},

"customer": {

"id": "123"

},

"operation": {

"id": 202,

"type": "sale",

"status": "success",

"date": "2020-03-19T14:26:25+0000",

"created_date": "2020-03-19T14:25:54+0000",

"request_id": "55e5e198a25827fc92c11262bb75936a0e9ddb1756169dd960b47aeb-00000001",

"sum_initial": {

"amount": 1000,

"currency": "EUR"

},

"sum_converted": {

"amount": 1000,

"currency": "EUR"

},

"code": "0",

"message": "Success",

"provider": {

"id": 1987,

"payment_id": "1584627957265",

"auth_code": "",

"date": "2020-03-19T14:26:24+0000"

}

},

"signature": "rv9EhRK3W1eRPzvlzZ3e3tttjgANs3z0Vi5OmH7GJ4qFqg=="

}

The following is the example of a callback for a purchase declined due to a time-out.

{

"project_id": 210,

"payment": {

"id": "ORDER_ID_1584627954",

"type": "purchase",

"status": "decline",

"date": "2020-03-19T14:26:25+0000",

"method": "neteller",

"sum": {

"amount": 1000,

"currency": "EUR"

},

"description": "Neteller purchase decline"

},

"account": {

"number": "netellertest@example.com"

},

"customer": {

"id": "123"

},

"operation": {

"id": 203,

"type": "sale",

"status": "decline",

"date": "2020-03-19T14:26:25+0000",

"created_date": "2020-03-19T14:25:54+0000",

"request_id": "55e5e198a25827fc92c11262bb75936a0e9ddb1756169dd960b47aeb-00000001",

"sum_initial": {

"amount": 1000,

"currency": "EUR"

},

"sum_converted": {

"amount": 1000,

"currency": "EUR"

},

"code": "20602",

"message": "Time-out",

"provider": {

"id": 1988,

"payment_id": "1584627957266",

"auth_code": "",

"date": "2020-03-19T14:26:24+0000"

}

},

"signature": "rv9EhRK3W1eRPzvlzZ3e3tttjgANs3z0Vi5OmH7GJ4qFqg=="

}

Related topics

The following topics might be useful when implementing payments through Gate:

Payout by using Gate

General information

To perform a payout through the Neteller method, merchant's web service sends a request with all the required parameters and signature to Monetix URL, and receives a callback with the payment result. The full sequence of the payout process is provided below.

- A customer orders a payout through the Neteller system.

- Merchant's web service sends the request for the payout processing by using Gate to the appropriate Monetix URL.

- Gate redirects the request to the Monetix payment platform.

- The payment platform performs all the necessary checks and processes the request.

- The reply with the request processing results is sent to the merchant's web service. For more information, see Response structure.

- The payment platform redirects the payout request to the Neteller service.

- The payout is processed on the Neteller side.

- Neteller sends the result notification to the payment platform.

- The payment platform sends a callback with the payment result to the web service.

- The customer receives the notification about the payout result from the web service.

The sections that follow discuss in more details the request format and the Gate parameters to use in the Neteller payment method and provide the information on the format of callbacks with payout results.

Request format

There are several things you must consider when using payout requests in the Neteller method:- You send payout requests by sending the

/v2/payment/wallet/neteller/payoutrequest by using the POST HTTP method. This is an e-wallet payments request group /v2/payment/wallet/{payment_method}/payout. - The following objects and parameters must be specified in any request:

- general—object with general request information:

- project_id—the project ID obtained from Monetix

- payment_id—payment ID unique within the project

- signature—signature created after you specify all the required parameters. For more information about signature generation, see Signature generation and verification.

- payment—object with payout information:

- amount—payout amount in minor currency units without any decimal point or comma except for cases where the currency does not have any minor currency units. If the currency has no minor units (that is, the number of digits for minor currency units is zero), then you must set this parameter to the amount in the major currency units. For the information on whether the currency has any minor units, see Currency codes.

- currency—payout currency in the ISO-4217 alpha-3 format

- customer—object with customer information:

- ip_address—customer device IP

- id—unique ID within the merchant project

- first_name—customer first name

- last_name—customer last name

- email—customer email

- account—object with account information:

- number—email address associated with the Neteller account. According to the operation protocol of the Neteller service it is required to validate the values that the customers specify on the web service side and allow only those values which correspond to the format of an email address.

- general—object with general request information:

- If required, you can also add any other additional parameters Gate supports.

Here is an example of data from a payout request.

"general": { "project_id": 200, "payment_id": "123", "signature": "8ff12bcdfa8496f8e93fd937f563d07...ad0d4bbe4c527be==" }, "payment": { "amount": 1000, "currency": "EUR" }, "customer": { "id": "customer1", "ip_address": "198.51.100.47", "first_name": "John", "last_name": "Doe", "email": "johndoe@email.com" }, "account":{ "number": "netellertest@example.com" }, }

Callback format

The Neteller method uses the standard format for callbacks to deliver payout results. For more information, see Callbacks in Gate.

The following is the example of a callback with an information about successful 10.00 EUR payout in the 210 project.

{

"project_id": 210,

"payment": {

"id": "ORDER_ID_1584628087",

"type": "payout",

"status": "success",

"date": "2020-03-19T14:28:57+0000",

"method": "neteller",

"sum": {

"amount": 1000,

"currency": "EUR"

},

"description": "Neteller payout success"

},

"account": {

"number": "netellertest@example.com"

},

"customer": {

"id": "123"

},

"operation": {

"id": 1000000201,

"type": "payout",

"status": "success",

"date": "2020-03-19T14:28:57+0000",

"created_date": "2020-03-19T14:28:11+0000",

"request_id": "e03c2b85a7f816f0ecf0a7cdd955515f5390dcb0a3de74525-00000002",

"sum_initial": {

"amount": 1000,

"currency": "EUR"

},

"sum_converted": {

"amount": 1000,

"currency": "EUR"

},

"code": "0",

"message": "Success",

"provider": {

"id": 1987,

"payment_id": "1595720491729",

"auth_code": "",

"date": "2020-03-19T14:28:56+0000"

}

},

"signature": "uQEJSDLG1wgoVwMwrbOPS9o+EV09aBakCA8xoeSkDpF/CCIYl1xbVw=="

}

The following is the example of a callback for a payout declined due to a time-out.

{

"project_id": 210,

"payment": {

"id": "ORDER_ID_1584628087",

"type": "payout",

"status": "decline",

"date": "2020-03-19T14:28:57+0000",

"method": "neteller",

"sum": {

"amount": 1000,

"currency": "EUR"

},

"description": "Neteller payout decline"

},

"account": {

"number": "netellertest@example.com"

},

"customer": {

"id": "123"

},

"operation": {

"id": 1000000201,

"type": "payout",

"status": "decline",

"date": "2020-03-19T14:28:57+0000",

"created_date": "2020-03-19T14:28:11+0000",

"request_id": "e03c2b85a7f816f0ecf0a7cdd955515f5390dcb0a3de74525-00000002",

"sum_initial": {

"amount": 1000,

"currency": "EUR"

},

"sum_converted": {

"amount": 1000,

"currency": "EUR"

},

"code": "20602",

"message": "Time-out",

"provider": {

"id": 1988,

"payment_id": "1595720491720",

"auth_code": "",

"date": "2020-03-19T14:28:56+0000"

}

},

"signature": "uQEJSDLG1wgoVwMwrbOPS9o+EV09aBakCA8xoeSkDpF/CCIYl1xbVw=="

}

Related topics

The following topics might be useful when implementing payments through Gate:

Payout by using Dashboard

- single payout—you specify the currency and amount for a payout available for this method and fill in all the fields required for the selected payment method on the Dashboard pages.

- as a part of a mass payment—all the parameters are specified in a CSV file. Refer to the Payouts by using Gate section for the parameters required by your payment method.

Information about completed payouts is available for viewing in the Payments and Manual Payments sections of Dashboard.

For more information about payout processing by using Dashboard, see Performing payouts.

Testing

General information

For the Neteller method the testing of purchases by using Payment Page and Gate, payouts by using Gate are available.

Testing can be performed within a test project, to enable and disable the testing availability, contact Monetix technical support via support@monetix.pro.

When performing a test payment, take into account that you must specify the identifier of the test project in the requests, the currency can be only BRL, EUR, GBP, JPY, RUB, USD and the interfaces of the payment forms emulator of Payment Page and Neteller differ from the production environment.

Test payments statuses

When testing purchases, the final payment status is determined by the amount specified in the request:

declinestatus with40000or40400amountsuccessstatus with any other amount

When testing payouts, the final payment status is determined by the amount specified in the request:

declinestatus with40000or40400amountsuccessstatus with any other amount

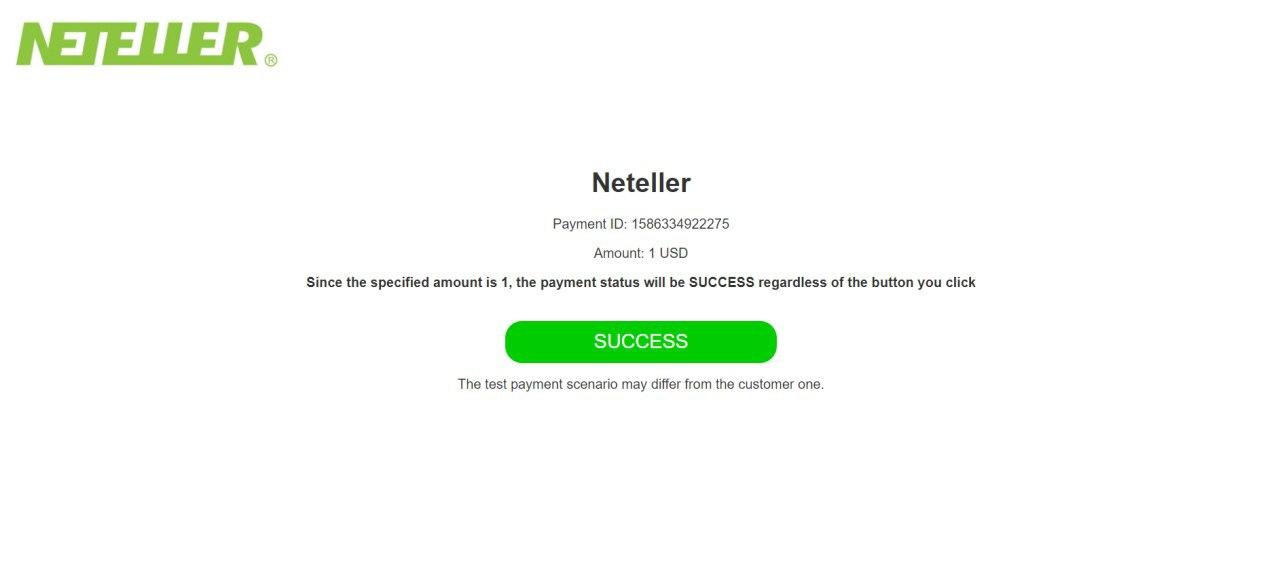

Testing purchase by using Payment Page

To perform a test purchase by using Payment Page, do the following:

- Send a correct test request for Payment Page opening to the payment platform.

- If the

neteller-walletmethod was not specified in the request—select the method on the emulator page. - Specify a random email address in the data entry field.

- Click the Success or Decline button (depending on the amount specified in the request).

- Accept a callback with information about the payment result.

The full information about purchase process by using Neteller through Payment Page is provided in the section Purchase by using Payment Page.

Testing purchase by using Gate

To perform a test purchase by using Gate, do the following:

- Send a correct test request for purchase to the payment platform.

- Accept a callback with redirection data.

- Go to the received URL and click the Success or Decline button (depending on the amount specified in the request).

- Accept a callback with information about the payment result.

The full information about purchase process by using Neteller through Gate is provided in the section Purchase by using Gate.

Testing payout by using Gate

To perform a test payout by using Gate, send a correct test request to the payment platform and accept a callback with information about the payment result. The full information about payout process by using Neteller through Gate is provided in the section Payout by using Gate.

Analysis of payments results

As with other payment methods Monetix offers, when using this method, you have several options to analyze the information about payments and operations.

You can load and analyze all the necessary information in Dashboard (dash-light.trxhost.com), for instance you can use the analytic panels in the Analytics section for this purpose.

Also, you can export the information for further analysis by using third party analytical tools. The following options are available:

- Dashboard allows you to download reports in CSV format by using the tools in the Reports section. You can perform export as a one-time or regular download of data to your local computer.

- Data API allows you to have payment information exported in JSON format and delivered to a URL you specify. The payment information is exported by means of sending requests to the /operations/get endpoint.

If you have any further questions regarding payment data analysis, contact Monetix technical support.